EVERY DAY, new words are introduced into our vocabulary as technology and new thought emerges. I wish to introduce a new term – ‘Abaxial Thinking’, which I am copyrighting at this point. I will define abaxial thinking as generating thought processes away from the norm. It is saying for example that the price of fuel should go up when the general thinking is that it should go down.

While the conversations have been focused on the reduction of the price of fuel and its possible impact on the economy, I would wish to posit that an abaxial thought would be that the price of fuel should in fact be increased at this time.

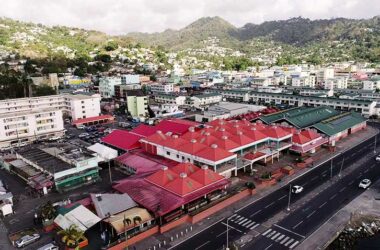

Governments have seen the importation of vehicles as a source of revenue. In St. Lucia the final cost of an imported vehicle is almost the equivalent of the cost of the vehicle CIF into St Lucia. There is almost 100% add on to the cost of the vehicle. When someone goes to purchase a vehicle, this high cost thus causes the mark up by the local car dealer to be increased. If all duties and taxes are removed from vehicles then there should be some reduction in the mark up by the local dealer also.

When you then go to the bank, the interest amount you pay on the loan will be increased the higher the loan. The banks also see car loans as an attractive source of revenue. We thus have a situation where the high price of vehicles is in the favour of the government, the car dealer as well as the banks. Abaxial thinking will suggest that we look at how the government can maintain the same revenue and the consumer can benefit in the process.

If a road tax is introduced of say $ 1.50 on a gallon of fuel, and the Government simultaneously says that all duties and taxes on vehicles are now removed, undoubtedly the consumer will benefit sometime in the future and the government’s revenue may not be affected in the present. It suddenly means that if you were looking for a vehicle say costing $ 60,000 the price of that vehicle may now go down to $ 28,000. Your monthly payment on such a vehicle is thus dramatically reduced.

Some will say that there are disadvantages of low prices of vehicles. One such thinking is that there will be more cars on the roads. I would say that increased mobility is an economic advantage for St Lucia. Another would say that the more cars on the road, the more damage will occur on the road network. As a civil engineer I will respond by saying that cars cause almost negligible damage to the roads and in fact in the design of roads the cars are not considered relevant. So for small island economies, increased mobility of your populace is a distinct advantage.

I am of the view that it is time that governments take bold decisions, that abaxial thinking be introduced in the development of policy and we have come to the end of regurgitation of foreign policies. The Government of Saint Lucia, as part of a strategy to reduce the energy intensity of the transportation sector, through Cabinet Conclusion no. 282 of 2014, revised the import duties and excise tax rates on electric and hybrid vehicles. The duties for eligible electric and hybrid vehicles now range from 5% import duty and 0% excise tax plus $1000 to 10% import duty and 10% excise tax plus $6000 depending on the vehicle’s age and engine capacity (for hybrid vehicles).

The number of these vehicles purchased can probably be counted on one hand. The encouragement of new vehicles and the removal of inefficient fuel consumption on vehicles due to age can create greater contribution to the national energy savings. Again, abaxial thinking at work, the regurgitation says that this is what is done in the USA and Europe, let us cut and paste the concept. Any modicum of research would have said that the cost of these vehicles would have excluded 95 % of vehicle owners and thus the net effect would have been negligible.

I am of the view that all duties and taxes on vehicles should be pursued by the government, that this will create a dramatic shift in the transportation sector, and the government can recover lost revenue from a road tax of say $ 1.50 on the cost of fuel. I am sure most St Lucians would rather be in a position to have a low car loan payment and pay a bit more on fuel, as against fuelling the profits of these banks. The decision would then allow the young hotel worker to be in a position to own a vehicle and thus be home early and not be standing by the side of the road at 10:30 p.m. hoping to get transport to her home.

So while the chorus and the response have been to reduce the cost of fuel at this time, I am saying remove all taxes and duties on vehicles and increase the cost of fuel by $ 1.50. Let the banks find alternative ways to make their huge profits; they have had a wonderful ride to riches with these high prices of vehicles. This good thing should come to an end.