Among my enduring boyhood memories in the days of pounds, shillings and pennies, were my trips from my Grass Street home, with a wad of small, red, notebooks and sacks of coins to make “deposits” into my parents’ accounts, at various Friendly Societies around the city.

Invariably, during this fortnightly ritual, my stops included the Closer Union hall, where the Workers Cooperative-of which my father was an executive member-was located, and the Castries Presbytery, which catered to a halo of Friendly Societies, such as the Holy Name Society, St. Vincent de Paul, and Sacred Heart of Mary. Deposits into each of these accounts probably did not exceed $5:00 in today’s money. Yet, I was always struck by the many members who were present during my visits and the obvious discipline and regularity with which deposits were being made. These Societies were features of every parish of the Catholic Church, thus creating an informal, nationwide, social safety net. Crucially, the members of these societies provided moral support to each other, during personal and family crises.

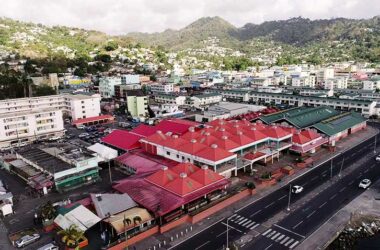

It was in this culture of cooperativeness, friendliness, and thrift, that “The Penny Bank,” — later named the St. Lucia Cooperative Bank and now 1st National Bank (FNB) — emerged in January 1938. It was the bank of choice for common people, such as farmers, dockworkers, domestic workers, and clerks. Moreover, it was the bank of early workers’ unions and cooperatives. It was the only bank used by my father, and thus it was the source of my first car loan, guaranteed by him nearly 50 years ago. This affinity prompted me to become a shareholder in the Bank as soon as my finances permitted. It’s in this capacity that I write this commentary.

Given its humble, indigenous, beginnings, I regarded FNB’s acquisition of the Royal Bank of Canada (RBC) as an exclamation point in its evolution. I was heartened that our country’s first, indigenous bank had “devoured” one of the early foreign banks in Saint Lucia. Consequently, it’s supreme irony that this acquisition is at the heart of the industrial dispute that rocked the FNB and our country, last week.

Disputes between workers and employers will occur. However, the contretemps between the FNB and its staff – who are represented by the National Workers Union (NWU), arguably the most powerful and effective Union in our country-surprised many FNB clients, shareholders and observers. Given FNB’s early history, which I assume its directors know well, and their collective competencies in banking, finance, law, personnel management and industrial relations, it’s disappointing the dispute was not resolved before it reached the Labour Commissioner (LC). Now, the matter is before the Minister of Labour. While the FNB exercised its right under the law, it’s noteworthy this was only done during the workers’ protest. It is equally troubling to note that in his response to the General Secretary of the NWU, dated 11 October 2024, the LC said that he was not aware the FNB had sought the intervention of the Minister. Anyway, you look at it, this doesn’t look good.

It’s safe to deduce the FNB did not expect the workers to strike. Had it considered such an eventuality, it would have also considered the loss of business and precious goodwill that would have ensued. On the face of it, the strike action cost the FNB far more than meeting the workers’ demands. Was the FNB being penny-wise and pound-foolish?

Sadly, the strike has disfigured the public image of the FNB. It has lost much public support, including, unfortunately, some of the nationwide acclamation it received for its early support for and association with Julien Alfred, dating back to her pre-Olympian years. Within minutes of receiving a circular from the FNB seeking support for its bid for the Eastern Caribbean Central Bank’s (ECCB) award for Customer Service, I would receive another petition calling for such support to the rescinded. Not good!

From my experience with the FNB over the past three years-which I’ve shared in this newspaper and with some of its Directors-it became clear to me that the FNB has some internal challenges. All business entities go through periods of challenge. Indeed, during much of the decade of the 2000s, the Bank of Saint Lucia (BOSL) struggled to the point where shareholders received no dividends. However, the turnover in the FNB’s leadership—it has had two Managing Directors in four years—does not inspire confidence, which is a crucial contributor to the success of all banks. Several experienced, senior managers were severed on the cusp of their retirement, and at a critical time during the bank’s acquisition processes.

Has the FNB grown too quickly? On April 1, 2021, it absorbed the activities and assets of RBC in Saint Lucia and on 1 August 2022, it assumed the operations of RBTT Bank Caribbean Limited in St. Vincent and the Grenadines (RBTT SVG). Did it adequately plan for these acquisitions? I can say with certainty that the FNB has not done a good job of integrating the mortgage records of former RBC clients into its system. Moreover, the details of the salary dispute suggest that it did not prepare for a frictionless absorption of RBC staff in its operations and the pay equality and equity issues that would arise.

I expect fellow FNB shareholders will press for an immediate resolution of the corporate governance issues and challenges confronting the Bank—which I’m told warranted the intervention of the ECCB–so that it can rebuild the trust and confidence of its internal and external stakeholders. The allegations of conflicts of interest within the Board, which went viral during last week’s workers’ strike, cannot be ignored. The rich and imposing legacy of the FNB as the “penny bank” and the “people’s bank” is at stake; so too is the legacy of the NWU, which has done much to uplift the living and working conditions of workers in our country over five decades.