Over the past nine months, we have been inundated with distressing information regarding our Citizenship by Investment (CIP) program. Concurrently, the Opposition has sounded the alarm, underscoring the potential pitfalls and risks associated with these developments. As a concerned citizen, I feel compelled to share my prognosis, which unfortunately paints a bleak picture of our nation’s future. Regrettably, the current administration has chosen to downplay the warnings of the Opposition and others, labelling them as mere scare tactics.

Let us fast-forward to the recent news of a US $3 billion penalty imposed by the US Treasury and Justice Departments on the Canadian TD Bank for enabling money laundering. I urge everyone to carefully read the entire CNN news report, as it reveals that several bank employees took kickbacks to facilitate tainted deposits, disregarding banking guidelines. This is deeply disconcerting and worrisome.

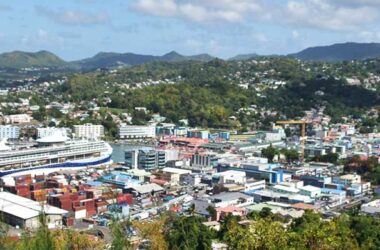

In light of this, I pose a question to all St. Lucians, particularly our business community: What if the Bank of St. Lucia (BOSL) were to face a similar predicament? The consequences would be catastrophic, would it not?

By the same token, our banking institutions must remain free from political interference to ensure honest and irreproachable operations. However, on a small island like St. Lucia, it is easy to connect the dots and question whether we are on the right track.

Consider this, Mr Evaristus Jn Marie holds multiple key positions in quasi-government and government organizations, namely Chairman of Bank of St. Lucia BOSL, Chairman of National Insurance Corporation NIC and Chairman of National Insurance Property Development and Management Company NIPRO. He was also recently appointed to the Eastern Caribbean Citizenship by Investment Regulatory Board. It is noteworthy to mention, that the Government of St. Lucia and the National Insurance Corporation jointly own 35% of the shares of Bank of St. Lucia. This concentration of key positions in the hands of one individual raises significant concerns about the potential for political influence over our financial institutions. Such consolidation of power could undermine transparency and accountability, creating a risk of favouritism and mismanagement in sectors critical to the country’s economic stability. Let it be clear, I am making absolutely no accusation against Mr. Jn Marie. I am simply pointing out the situational potential for abuse.

Mr. Lyndon Arnold serves as Chairman of Invest St. Lucia and Deputy Managing Director of BOSL, while Mr. Lance Arnold, his brother, is the Director of Global Ports Holdings Eastern Caribbean, having previously held a senior management position at NIPRO. It needs to be noted that Mr. Lyndon Arnold, the Chairman of Invest St. Lucia, was a senior member of the government’s team that negotiated the terms and conditions of the Global Port Holdings agreement. Subsequently, his brother was appointed as a director of the company. Yet another association that raises similar concerns as referred to above.

Given the numerous accusations against the Deputy Prime Minister and his troubled history of questionable appointments-most notably the controversial selection of Saudi Arabian billionaire, Dr. Walid Juffali to the International Maritime Organization in 2014-there is a pressing concern for our nation. This toxic concoction of suspect appointments topped off with apparent overt nepotism sends a troubling message at a time when our Citizenship by Investment program, along with our correspondent banking relationships, face intense scrutiny from US authorities.

The shocking developments at TD Bank expose the vulnerability of our correspondent banking relations and highlight for the need for our banks, particularly the Bank of St. Lucia, to be shielded from political interference and cronyism. To achieve this, the regulatory body should be divorced from the influence of politicians. Robust corporate governance structures should be implemented within the financial institutions. Politicians and government officials should be prohibited from holding influential positions, and conflicts of interest strictly avoided, to ensure the banking system operates with transparency, accountability, and integrity.

In conclusion, I urge all St. Lucians to carefully consider the implications of these developments and the potential risks to our nation’s financial stability and the integrity of our investment and financial institutions.