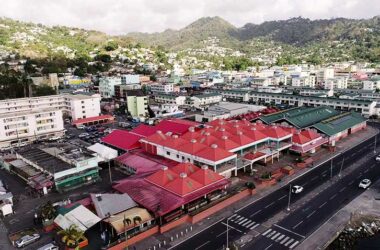

ST. LUCIA is currently trying to keep its head above water in a global context where traditional global partners are no longer available, where Trump is leading the charge on “Putting America First”, where our colonial “mother country” is now leaving Brexit — and added to this is the increase in global terrorism, particularly now-online strategies.

Against this backdrop, St. Lucia, under Prime Minister Allen Chastanet, has – yet again — achieved another unenviable milestone, this time getting on a European Union (EU) blacklist.

I have heard the CARICOM, the University of the West Indies (UWI) and even Prime Minister Chastanet’s explanations and objections. However, none can erase the fact that St. Lucia in 2017 was “named and shamed” internationally!

What does this mean for our Citizenship by Investment Policy (CIP)? Or our fragile tourism industry? What does this mean for our visa-free travel to Europe? These are the critical issues for us as citizens.

Anyone who understands the new global context would not be astounded by the European Union’s blacklisting. The international community is placing greater attention on tax havens, particularly since “The Panama Papers” and “The Paradise Papers”.

We all recall the The Panama Papers — those leaked documents of 2016 that detailed financial client information for more than 214,488 offshore entities. These documents belonged to the Panamanian firm Mossack Fonseca and were supposed to have exposed a system that enabled wrongdoing, hidden by secretive offshore companies.

Over 140 public officials, including relatives and friends of politicians, as well as retired politicians in over 50 countries, were connected to offshore companies in 21 tax heavens. In fact, the founders of the law firm at the centre of the scandal were recently arrested on money laundering charges as part of investigations into the Odebrecht Affair, Brazil’s largest-ever bribery scandal.

This was soon followed by “The Paradise Papers” of 2017, the latest in a series of international journalistic exposés of the offshore financial industry, which includes another elite offshore law firm named Appleby. This has triggered another round of tax-related investigations by governments around the world. The European Union, like other international bodies, has therefore become aggressive in its pursuit of tax havens.

St. Lucia, in December 2017, joined this exclusive group of 17 tax havens listed by the EU (including other countries like South Korea, Panama and United Arab Emirates). These countries are basically being identified by the EU as “not doing enough” to crack down on offshore avoidance schemes. But what is even worse is the potential sanctions that could be enforced on members on the blacklist.

The EU said that, as a first step, communication would be sent to all jurisdictions on the list, explaining the decision and what they (the countries) can do to be de-listed. By my understanding, the EU is, in essence, suggesting these territories are colluding in tax avoidance and have refused to commit to tax transparency and information exchanges with national authorities.

I am awaiting, hopefully – and with bated breath — that the Prime Minister and Minister in his Ministry of Finance will be forthcoming with the contents of the EU letter on the reasons for St. Lucia being on this blacklist.

But, as we wait, according to the internet definition, a tax haven is “a country or territory where, on a national level, certain taxes are levied at a very low rate or not at all, essentially for favourable tax conditions”. It also refers to countries which have a system of financial secrecy in place. Now, as St. Lucia has only recently won the “race to the bottom” of the regional CIP, why would we want to find ourselves on a list referencing us as a tax haven?

Mr. Prime Minister, can you advise us as to what was your thinking in this regard?

I mean, as a lay person, I see the implications as loss of investment, as international institutions will be refusing to conduct business in this jurisdiction or experiencing increased cost when trading, or possible loss of our Shenghen visa-free access and CIP investment being further threatened.

According to the notable Barbadian and Caribbean academic, Professor Sir Hilary Beckles, who is also Vice Chancellor of the UWI, “The unfavourable and unfair categorization of certain CARICOM countries is likely to result in reputational damage, encouragement of ‘de-risking’, including the withdrawal of correspondent banking services and the imposition of costs in the adjustment to new onerous regulatory requirements.”

So why would the two economic gurus – the PM and his Minister in his Ministry of Finance –have allowed St. Lucia to be in this predicament?

Interesting enough, though, there are another 47 countries that have also been included in a “grey” list of countries not compliant with EU tax standards, but who have committed to change their rules.

These countries will have to adopt EU rules by the end of 2018 or in 2019 to avoid being included on the blacklist.

So the first big question today is: Why is St. Lucia not on the “grey list” instead of the “black”?

And the other one is: Why were we so hesitant to commit to the change that would have avoided this international embarrassment?

As of this week, the EU has removed 8 of the 17 countries initially blacklisted in December. Panama, South Korea, United Arab Emirates, Barbados and Grenada are included among those removed. These countries have agreed to change their tax rules in order to conform. Prime Minister Chastanet, please explain why are we still on the list when others have been removed?

We, dear readers, must not only wait, but we must also press for the answers!