In a Budget Address that centred on people-centric growth and bringing relief to Saint Lucians, Prime Minister Honourable Allen Michael Chastanet announced Personal Income Tax Reform that would see thousands of low-income earners pay less and in some cases no personal income taxes.

This is a bold initiative and in keeping with the Government’s promise of less onerous taxes on the people of Saint Lucia.

Under the theme “Growth by Empowerment for a Better Future” the Minister for Finance presented the Appropriation Bill 2019-2020 which focused on “opportunities that will propel every Saint Lucian to an acceptable standard of living and offer the chance to build wealth for themselves and their families.”

Part of this plan, explained the Prime Minister, was the reform of the personal income tax system to make it simpler, more progressive and less burdensome.

During his presentation to the House of Assembly on Monday, April 15th 2019, the Prime Minister explained the challenges and disadvantages of the current system, among them: the burdensome filing of a number of documents; many individuals find the tax computation complicated with the four tax bands and four tax rates; the system is not sufficiently progressive, as the greatest burden of taxation does not always fall on the higher income earners.

The Prime Minister explained that the new regime seeks to provide income tax relief to lower income earners.

“A large number of low-income employees will no longer be required to pay personal income tax, while others will benefit from reduced tax liabilities,” said PM Chastanet. “However, high-income earners will be expected to pay more as a result of the progressive nature of the tax system. As such, the new regime is expected to be revenue neutral with no adverse impact on the government’s revenue collections from PAYE.”

Expected to come into effect 1st January 2020, the new system will be as follows:

- The personal allowance will be increased from $18,000 to $23,000. What this means is that for an average income earner, the first $23,000 of annual income will be tax free;

- There will be three (3) tax bands with the following rates:

(i) The first $0 to $10,000 of chargeable income will be taxed at a rate of 10%,

(ii) the next $10,001 to $20,000, at a tax rate of 20% and

(ii) the remaining amounts above $20,000, at a tax rate of 30%;

- Limit the amount of total deductions that can be claimed up to a maximum or cap of $25,000 in any given year.

- Restrict the number of allowable deductions to the following four (4) categories: Housing Deductions, Future & Financial Benefits, Medical Deductions and Child and Education Benefits.

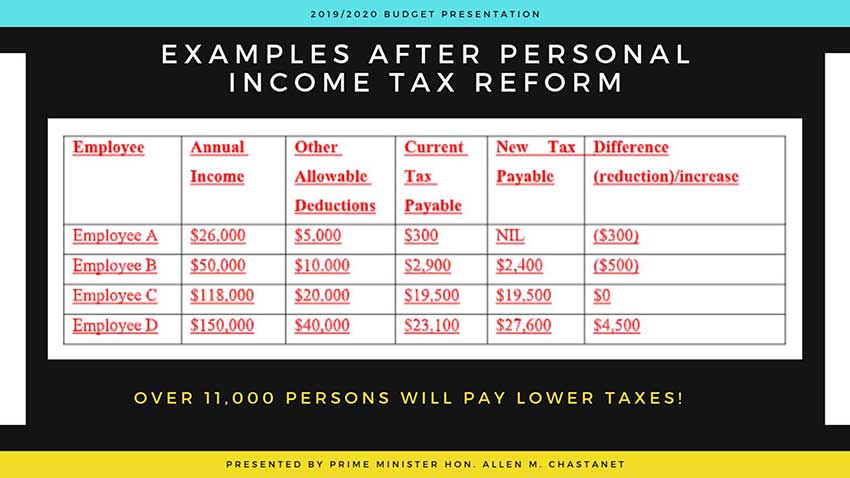

The Prime Minister then demonstrated in detail how progressive this new system will be with low earners as beneficiaries.

“An employee with annual earnings of $26,000 and allowable deductions of $5,000 pays tax of approximately $300 under the existing regime. However, under the new regime, this employee will not pay any tax, resulting in a savings of $300,” he noted. “An employee with annual earnings of $50,000 and allowable deductions of $10,000 pays tax of approximately $2,900 under the existing regime. However, under the new regime, this employee will pay $2,400, which is a reduction of $500.”

The Minister for Finance further noted that pensioners and persons 60 years and over, will not pay any tax on the first $31,000 of their income compared to $24,000 under the current regime.

Preliminary assessments of the proposed reform showed that for a given year, over 11,000 persons or approximately 50% of filers will pay lower personal income taxes under the proposed regime.

The Prime Minister added that the greatest number of beneficiaries under this reform are individuals earning incomes ranging from $20,000 to $30,000 and $30,000 to $40,000.

“In these two income brackets, some 3,570 and 3,280 individuals will benefit. My government anticipates significant tax savings for the majority of individuals who will be better off under the proposed tax regime,” stated PM Chastanet.

The Prime Minister said it is anticipated that the entire country will benefit from the new tax regime and this will have a spill-over effect on the economy as a whole as consumer spending power will increase.

Who is advising the Prime Minister on Tax reform