HOW much do we value consultation and consensus in these little islands of the OECS?

Several weeks after a new Banking Act went through the St Lucia Parliament without so much of a whimper from anywhere– at least not publicly as far as we can tell– concerns are now being aired about the measure and this is coming from no other influential body than the Chamber of Commerce.

But the Chamber is not alone, since passage of the legislation in some of the islands has also met with similar expressions of concern. In Antigua, some bank workers went on strike because they were unhappy with some of the stipulations and regulations contained in the Act. There were also concerns there about the pecking order for compensation in the event that a bank has to be liquidated.

In Dominica, opposition parliamentarians raised concerns about the status of credit unions in the new Act and about the “excessive” new powers given to the Eastern Caribbean Central Bank.

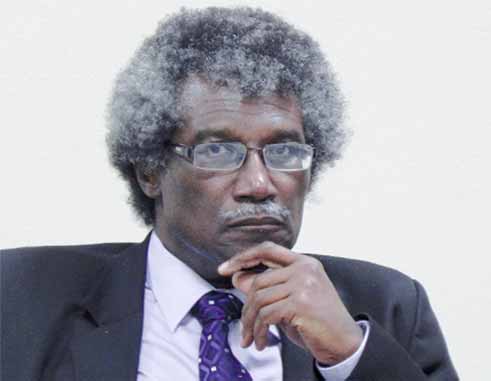

On the other side of the coin has been the compelling arguments of the ECCB and its Governor Sir Dwight Venner that the new regulations have become imperative in the aftermath of the most recent international financial crisis. Since then two major insurance entities in the region have collapsed and the ECCB has had to intervene in two banks in Anguilla to protect depositors’ money, among other reasons.

Sir Dwight has also explained that the new Banking Act was to ensure that the sub-region’s legislation is compatible with international standards, in order to preempt future crises, to enable the authorities to resolve failed banks more efficiently and effectively, to protect depositors and to maintain financial stability.

Now, no one in their right minds would have a problem with such an agenda. The problem is that there has been so little consultation in the islands to allay the fears of the people about the purposes of such a fundamental piece of legislation before it went to the respective parliaments.

The very fact that our Chamber of Commerce is only now discussing the Act long after it has made its way through the parliament underscores the very callous manner in which this measure has been pushed through in St Lucia although we are unaware that things were any different elsewhere except, ironically, in tiny Montserrat where the Premier invited the media to join legal practitioners and senior public servants to hear a presentation and discuss the new legislation before presenting it to the island’s parliament.

One would have expected that given the importance of this new Banking Act and its far-reaching implications, the government would have led the way in encouraging public discussion and debate of its contents in the spirit of transparency that we so often hear about these days, but is so often never practised.