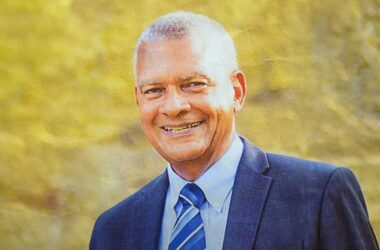

Opposition Leader Philip J Pierre last Sunday offered some brief but harsh remarks about the recent bridge-financing transaction between the National Insurance Corporation (NIC) and the Government.

Pierre made the pronouncement at his party’s open session annual conference, saying that it would be an act of grave irresponsibility if the Opposition did not warn the Government to be cautious with pensioners’ funds.

The transaction Pierre spoke of involved the government borrowing from the NIC some $100 million to settle two outstanding bond issues that matured end of July.

Finance Minister (at the time) Ubaldus Raymond said the loan was requested because of a cash flow problem experienced by government, hence its inability meet its commitment to the bonds at the time of their maturity.

The loan was given and repaid within a month’s time. However, from then until now, there are questions about the transaction that neither the Government, nor the NIC, have taken time out to answer.

The Voice is on record as having repeatedly asked of the NIC to explain the transaction. The NIC’s management requested that written questions be submitted, of which The VOICE submitted five. To date, however, the NIC has yet to reply to the questions or to grant a requested interview.

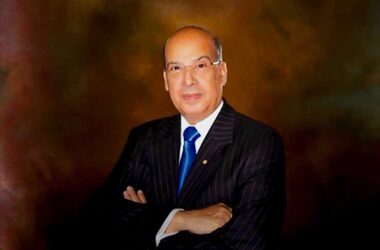

Efforts this week (on Thursday) The VOICE again made efforts to get NIC’s Managing Director Mathew Mathurin to respond to some of the claims made by Pierre at Sunday’s SLP conference and to clarify some of the points raised by the list of questions handed to the NIC early last month. But all our efforts were futile. We were (yet again) told by someone at his office that he was “at a meeting.”

Pierre said Sunday: “We sounded the warning of caution on behalf of the people whose money is being secretly juggled in a Ponzi scheme. Fact is, the Government could not pay its debts when they became due, even if they had adequate notice. They were forced to use the pensioners’ fund, not for development purposes, but to avoid defaulting on their bond commitment of $100 million.”

The NIC loan to the government had a one-and-a-half percent interest rate attached to it. The understanding, it seems, was that government had planned to roll the bonds over to get cash to pay back the NIC.

Was it the NIC who purchased the newly rolled-over bonds? That was one of the questions posed to the NIC by this reporter. But like the other four, the answers are still blowing in the wind.

If so be the case this would mean that the NIC gave the government $100 million. That money was then given to the bond owners. Government would then put more bonds on the market to raise capital to pay back the NIC. The theory that abounds in the land was that it was the NIC who purchased the new bonds. Clarification on this was sought through the NIC all to no avail.

But if so be the case it would mean that the NIC bought bonds to pay back the loan it gave to the government. This would mean that the NIC in total gave government in excess of $100 million, one set of money as a loan and another set to purchase bonds.

This would also mean that the NIC is currently holdings bonds purchased from government. All this could very well be conjecture however to arrive at that summation either the government or the NIC must speak out on that transaction.

A level of transparency would be achieved if the NIC or government explained the process such a transaction would have to go through and its results.

Also, describing the transaction in layman’s terms would augur well for pensioners, since all have a vested interest in how their NIC money is used. For instance it would have been sensible on the part of the NIC to explain what is a Bridging Finance Facility, what was it used for in this case, what was for sale who bought it, when and how, at what cost and to what benefit?

Another question in the list of questions to the NIC by this reporter was whether the assessment process as rigorous as all other and is the NIC satisfied with its rate of return on this investment?

Further, are the government and the Corporation better off as a result of this transaction? And did it appear that the NIC pulled off what critics said it couldn’t, meaning this transaction? Why no announcement of what should be good news? And lastly what other good news the NIC would like to share with its shareholders and pensioners?