INSURERS and re-insurers are facing major losses in the wake of the damage done in the Caribbean and the United States by Hurricanes Harvey, Irma and Maria. These losses will have a direct and immediate impact on insurance premiums across the entire Caribbean and the Eastern seaboard of the U.S.

Higher building and flood insurance costs coming on top of the costs of rebuilding damaged properties will prove to be too expensive to many homeowners and proprietors of businesses. Consequently, even as reconstruction takes place in the several islands that were hammered by these violent storms, there will be many abandoned sites for many years to come. People who find the costs of new insurance too high might simply opt to collect insurance payments, if they were insured, and walk away.

Those homeowners and other proprietors, who were not insured or were under-insured, have an even greater problem. They have to find the money from their own resources to rebuild and they might well find that an impossibility. Hurricanes don’t only destroy properties and take lives — they also create unemployment and increase poverty – something that those who deny climate change and global warming need to understand.

Insurers and re-insurers will raise their rates for certain in the coming weeks. Some might collapse under the burden of payouts from the hurricanes. Those that survive will increase premiums not only because they have to recoup their losses but also because they have to cover the enlarged risk posed by bigger and fiercer hurricanes.

Global insurers and re-insurers have already issued profit warnings. For instance, Lloyd’s of London has announced that it expects net losses of US$4.5 billion from Hurricanes Harvey and Irma. Lloyd’s 80-plus syndicates are reported to have already paid out more than US$160 million in claims from Harvey and more than US$240 million from Irma with more claims to come from the ravages of Hurricane Maria. And, Lloyd’s of London insurer, Beazley, said losses from Hurricanes Harvey, Irma and Maria and a series of earthquakes in Mexico would reduce its 2017 earnings by about US$150 million. U.S. property insurer, Chubb Ltd., estimated after-tax losses of up to US$1.28 billion from Hurricanes Harvey and Irma, with claims arising from Hurricane Maria not yet taken into account.

So, insurance premiums will increase and a few insurance companies might even decline coverage of certain properties unless they are satisfied that they are built to withstand Category 5-plus hurricanes, which has become the new normal.

It should be fairly obvious that insurers and re-insurers will take the view that the rewards of providing insurance cover might not be worth the risk, given the ferocity of hurricanes. The only thing that would persuade them to take a different and more favourable position is the legislation and implementation of codes that require all buildings to adhere to high standards of resilience.

Governments throughout the Caribbean, including those that have been spared hurricanes in recent years, will now have to legislate new building codes and they will have to police their implementation with stringent penalties for builders who fail to meet them.

In this regard, there is a lesson to be learned from Mexico City, where in the wake of repeated earthquakes over 30 years, the government legislated tighter building codes and better construction materials. Those building codes saved Mexico City from a worst disaster than it experienced last month. But, less devastation would have occurred had enforcement of the codes not been deeply flawed and uneven.

So, the two lessons from the Mexico City experience are that strong building codes are an absolute necessity and strict enforcement is also vital to save lives and protect property.

As hurricane-damaged Caribbean countries now begin the long and tortuous process of rebuilding, legislation of stronger building codes and enforcement of those codes are imperative not only to withstand the force of more powerful storms, but also to convince insurers and re-insurers to continue giving property owners adequate insurance coverage.

Caribbean countries that have not suffered from hurricanes in recent years ought to follow the same pattern. Allowing rebuilding at standards that applied previously is a prescription for catastrophe. Year after year, the region could be faced with a cluster of countries being decimated as has occurred this year. And, if that were to happen, the region could become uninsurable, leaving little or no opportunity for rebuilding and ruining economies irreparably.

All Caribbean countries are vulnerable and any of them could be a victim. In this connection, the legislation, implementation and policing of stringent building codes designed for the greatest resilience has to become the benchmark for the entire region.

The time to legislate and implement that benchmark is now. Waiting for a disaster before taking these measures would be a huge mistake for which the entire Caribbean would pay dearly with few, if any countries or agencies, coming to their rescue.

All governments and their disaster preparedness organisations should begin spreading a message that resilient building across the length and breadth of their nations is essential. No person likes to expend money, particularly if no immediate benefit can be seen for the expenditure. But, regret for not spending to achieve a higher level of resistance would serve no purpose in the wake of another hurricane’s devastation.

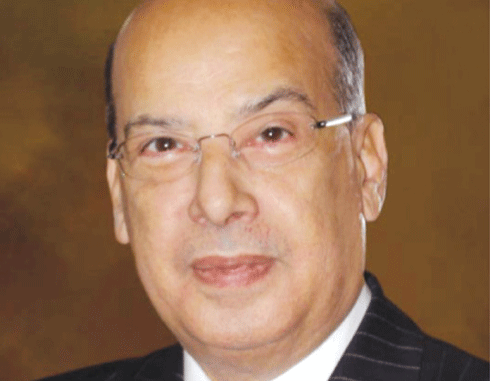

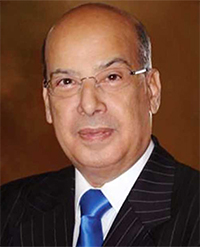

Responses and previous commentaries: www.sirronaldsanders.com

(The writer is the Ambassador of Antigua and Barbuda to the US and the OAS. He is also a Senior Fellow at the Institute of Commonwealth Studies at the University of London and at Massey College in the University of Toronto).