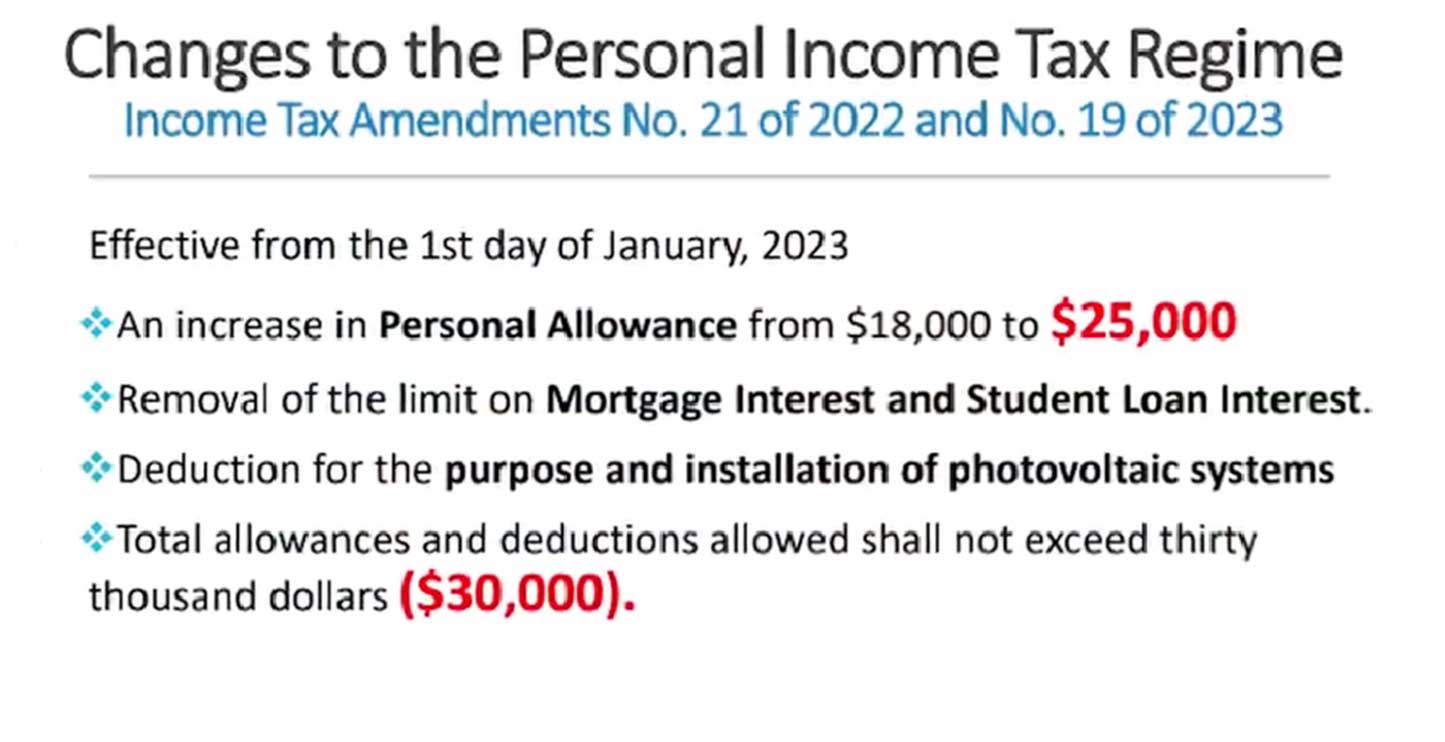

The Inland Revenue Department (IRD) Thursday announced that it had made changes to its personal income tax regime. This move will affect the filing process the IRD said, noting that there will be a cap “on allowances” and that (most significantly) personal allowance has moved from $18,000 to $25,000.

For the income years 2023 to 2025, “allowances and deductions excluded from the overall cap of $30,000 are; personal allowances, the deduction for medical expenses, expenses relating to the purchase and installation of solar photovoltaic systems or related components,” the IRD said.

“A claim for our solar photovoltaic system has not been part of our claim in the past so this is added to (the) 2023 filing. If you decided to change your electrical system (to solar) then that allowance is granted,” IRD Comptroller Marcia Vite stated.

With reference to tax bands (the amount of income which will be taxed at a particular percentage), Vite noted that in the past there were four “so that has been changed to three so you have zero to 15,000 at 15%, $15,001 to $30,000 at 20 percent and anything over $30,000 is at 30%.”

She encouraged persons to “go on our website-irdstlucia.gov.lc, (and) have a look at what we have (on) there. All of that information that I have explained is on our website so you can …. send us an email should you need clarification – customerservice@ird.gov.lc, or you can file online, that is easier for taxpayers.”

“I know that it’s a lot to take in so we will continue to have our taxpayer service officers available for further explanation or to assist you in filing,” Vite added.

Individuals are advised to file their tax returns before March 31.