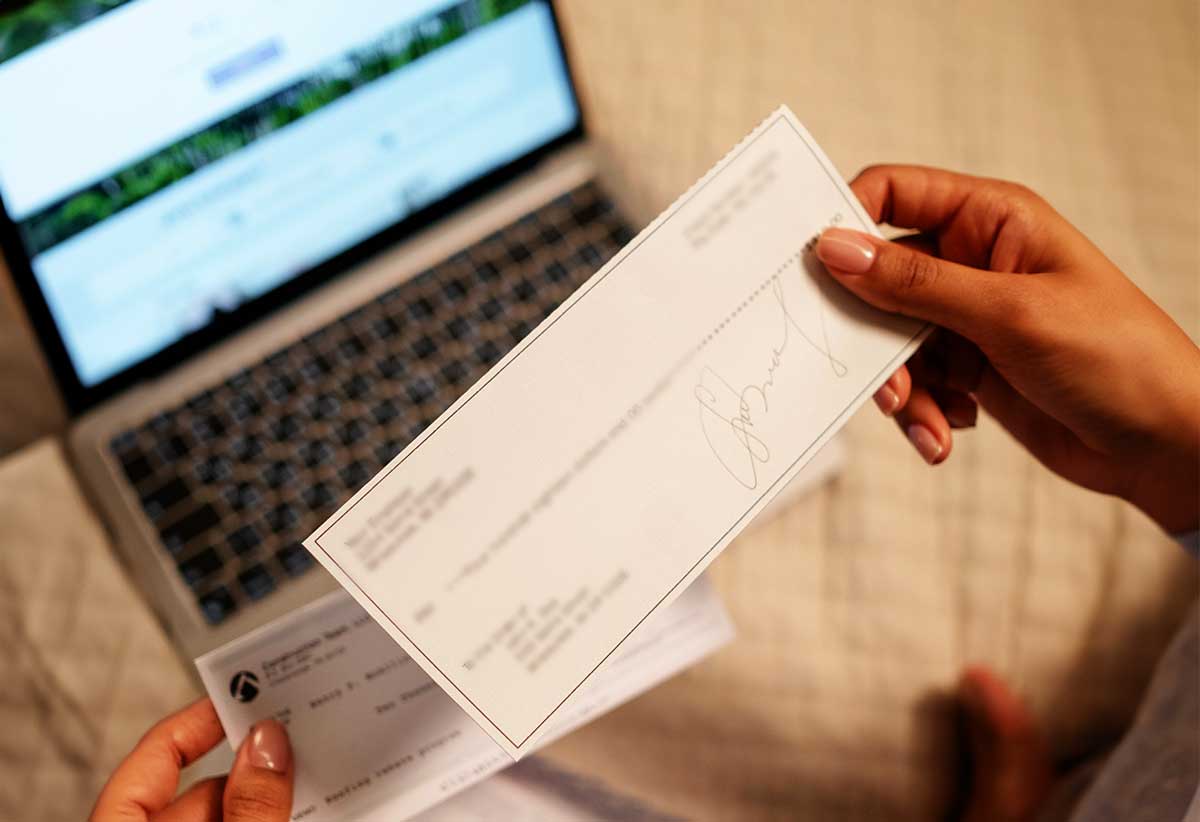

THE Government of Saint Lucia (GOSL) has announced that it will pay out $20 million in outstanding tax refunds all of which have already been allocated to the Inland Revenue Department (IRD).

According to the Office of the Prime Minister, the IRD is expected to payout $10 million in December and the remaining ten will be disbursed between January and March of 2024.

“For the first time in Saint Lucia’s history, nearly $40 million in outstanding tax refunds will be paid out in a single financial year (2023/24). From July 2021 to December 2023, the Inland Revenue Department will have disbursed $30 million in tax refunds,” the PM’s office said.

“Prime Minister Pierre and the Government of Saint Lucia are committed to accelerating the tax refunds process to ensure that taxpayers get their refunds in a timely manner; hundreds/thousands of Saint Lucians can expect to receive their tax refunds cheque in time for Christmas,” a release from the PM’s stated.

Last month, Pierre told reporters “we promised it and we are going to be paying it between now and December.”

According to reports, Pierre disclosed that the IRD had issues disbursing the money, however, failed to provide details.

As for the ‘Refunds Process’, the IRD on its website (irdstlucia.gov.lc), stated that it will “issue your notice of assessment with your refund cheque, if you are entitled, within reasonable time. If your return is a previous year return, incomplete, incorrect or needs reviewing, it may take us longer. If you provided a valid Saint Lucian bank account details in your return, your refund will be deposited onto it. If valid account details are not provided, your refund cheque can only be collected at our head office or it can be mailed to you via the post.”

On ‘Refunds as Offsets’:

“If you owe money to the IRD because of a delinquent or outstanding debt, the IRD can offset that liability with any available refund payments; the IRD may also withhold the entire amount to satisfy the debt. The offsetting will be detailed in your Notice of Assessment. You can also request that your refund be used to satisfy your or another taxpayer’s liability. Please make such requests via a formal letter addressed to the Comptroller of the IRD.”

For Emergency Refund Requests:

The IRD allows “for the early issuance of tax refunds due to an emergency or urgent situation for the taxpayer or his/her dependents. There are only three situations deemed as emergencies:

– Educational expense

– Medical emergency

– Permanent emigration from Saint Lucia

You are to make this request via a formal letter addressed to the Comptroller, along with documented proof of that emergency, such as a medical invoice or bill, tuition fees statement, one-way ticket/itinerary.”