Like everywhere else, the Caribbean Community (CARICOM) simply cannot escape the global repercussions of the continuing Russia-Ukraine crisis.

While politicians and diplomats argue over approaches and responses, the crisis is already producing increased energy prices for everything from fuel to cooking gas.

Now the region must brace for an unavoidable and inescapable food crisis that’s already started to bite in Europe and North America – and is heading CARICOM’s way faster than the discussions can offer solutions.

Take the price of wheat, which influences the price of flour.

According to TIME Magazine on March 8, 2022: “In Egypt, the world’s biggest wheat importer, prices for (some) unsubsidized bread have jumped in the past week;” and “bakers say unsubsidized bread prices are rising because of higher costs since the invasion of Ukraine…”

TIME added: “The war has already driven wheat prices 70% higher in Chicago this year and is threatening to upend global food trade. Russia and Ukraine are vital suppliers of grains, vegetable oil and fertilizers, which means that supply disruptions will be felt all over the world. Wheat prices have surpassed levels last seen during the 2008 global food crisis — which helped spark widespread protests — and a United Nations index of food prices hit a record in February.”

The Agricultural Market Information System said: “In the near term, food prices in world markets should be expected to rise further amidst all the uncertainty and this will add to global food insecurity.”

According to the US Department of Agriculture, Russia and Ukraine together accounted for nearly 29% of global wheat exports last year and the conflict has jolted global wheat prices higher.

Same with the results of the US ban on Russian oil imports.

On March 8, a UK Guardian article headlined ‘How the US ban on Russian oil risks splitting the West’s response’ noted: “Russia accounts for just 7% of the oil imported by the world’s biggest economy” and “while three-fifths of Russia’s oil exports go to the EU, only 8% goes to the US.”

American motorists were already paying higher pump prices (even before the latest surge in the cost of Brent crude above $130 a barrel) — and (as President Biden also predicted) will soon be paying even more.

Oil prices are already up by over 70% since January – and with no sign of lowering any time soon.

The Oslo-based consultancy Rystad Energy has predicted that a complete ban on Russian oil and gas could send crude prices to US $200 per barrel, way above the previous milestone of $147-a-barrel, a peak reached in 2008.

Meanwhile, the effects of the US-led sanctions against Russia are already being felt and measured in the UK.

According to the Guardian: “UK living standards are on course for their biggest one-year fall since modern records began in the mid-1950s, with the war in Ukraine putting at risk the post-pandemic recovery. All of which makes it important that sanctions work quickly. The longer the economic war, the higher the cost.”

But US Secretary of State Anthony Blinken kept warning Americans all of last week that they should prepare to bear the strain at the pumps and elsewhere, as the crisis will indeed last long.

Guardian Economics Editor Larry Elliott, also writing on March 8, reported: “The shockwaves from the Russian invasion of Ukraine will cut UK living standards by £2,500 per household, lead to more persistent inflationary pressure and slow the economy to a standstill next year, economists fear.”

The next day (March 9) market observers noted oil continued its rally near US$126 a barrel after US President Joe Biden said the US would ban the import of Russian crude that will further strain global energy markets.

Futures in New York had also soared more than 35% and settled at the highest since 2008; London said it would also phase-out Russian crude imports by the end of the year; and Shell and BP reported they were halting new purchases.

But other European nations dependent on Russian supplies are very reluctant to follow the US and UK.

The crisis has ruptured commodity markets — from metals to grains — sparking concerns that the global economy is heading for a shock, just as countries emerge from the COVID-19 pandemic. Banks and traders were predicting even-higher crude prices and already-tight energy markets are being stretched.

But the cost of the effects of the sanctions against Russia are already estimated in the UK.

Guardian Economics Editor Larry Elliott, writing on the same day (March 8) reported: “The shockwaves from the Russian invasion of Ukraine will cut UK living standards by £2,500 (US $5,000) per household, lead to more persistent inflationary pressure and slow the economy to a standstill next year, economists fear.”

Then came the expected shocker: On March 9, Reuters reported: “Ukraine’s government has banned exports of rye, barley, buckwheat, millet, sugar, salt, and meat until the end of this year, according to a Cabinet resolution…”

Effects will be unavoidably felt in every household across the Caribbean and Latin America, where the cost of flour – a staple food — can be expected rise and float like with baking-powder treatment.

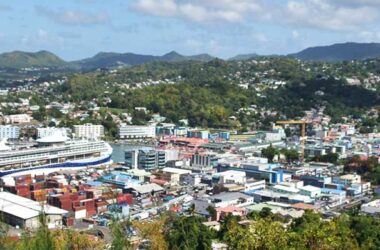

With CARICOM responsibility for lowering the region’s food import bill and reviving Caribbean agriculture in ways that will ensure everything from economic sustainability to nutritional value and import substitution, the Russia-Ukraine crisis has only made the task ahead even greater for Guyana.

Guyana is already offering the leadership, but it’s ultimately for each CARICOM member-state to do what’s needed to ensure the necessary adjustments at home are in tandem with regional aims and objectives.

Leadership always matters in these regional matters, but it’s always the speed of adjustment to new realities that decides just-how-fast necessary changes happen – again boiling-down to just-how-much each nation will look beyond its borders.

As always, Time will tell – but this time, it’s crystal-clear it’ll be sooner than later!