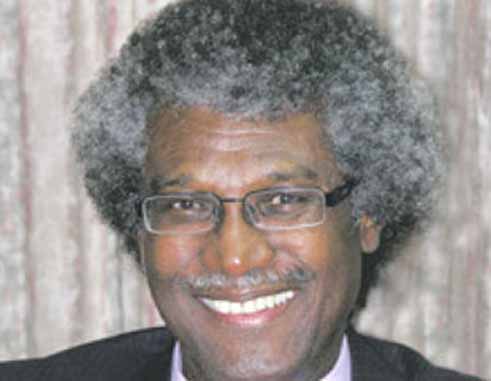

GOVERNOR of the Eastern Caribbean Central Bank (ECCB), Sir Dwight Venner wants the discussion on the new Banking Act of countries for the Eastern Caribbean Currency Union (ECCU) to be wide ranging and open-minded, arguing that the bill provides for that type of discussion.

Venner, in a video conference sit-down with journalists from the ECCU Wednesday night said that a lot of the discussion on the Act thus far had been focused on very narrow individual interests and personal animus towards the Central Bank.

“This is an insular and inward looking approach which is out of sync with the global environment in which we exist. For these reasons and others, the discussion has become highly political instead of objectively and soberly reflective on the times we live in and the future of our countries in a very competitive and daunting international environment,” Venner said.

He said that while a number of issues have come up in discussions on the new Banking Act such as the amount of paid up capital, the fit and proper criteria for directors and managers, the role of external auditors, license fees, and a few more, the issue which seems to have animated people the most is the power of the Central Bank.

“This raises some very important issues for us as a society and how we exercise the balance between public and private interests, the accountability of unelected officials, the role of the courts, the perceived operations of the Central Bank and its constituent parts – the Monetary Council, Board of Directors, Governor and Management. Questions which have not been prominent are related to the protection of depositors, the role of banks given our stage of development, and the importance of corporate governance within the financial, private and governmental sectors,” Venner said.

He added that the new Banking Act attempts to address major issues in the banking sector following the fallout from the global recession.

It also attempts to correct the deficiencies in the previous Act to ensure that “our legislation is compatible with international standards, in order to preempt future crises, to enable the authorities to resolve failed banks more efficiently and effectively, to protect depositors, and to maintain financial stability,” Venner said.

According to the ECCB Governor, the global crisis, which started in the United States of America with the subprime mortgage market collapse, exacerbated by the fall of Lehman Brothers, a very important and interconnected financial institution, has had a major negative impact on financial systems worldwide and the financial systems and economies of the ECCU.

“The fall of CLICO and BAICO, two major regional financial institutions, has had a marked effect on our countries and is still in the process of resolution, even though significant progress has been made. The ECCB has had to intervene in several domestic banks which had become insolvent. The international financial community led by the Bretton Woods institutions, the International Monetary Fund and the World Bank and the Bank for International Settlements, from which the central banking community seeks guidance on these matters, established special committees such as the Financial Stability Board to examine and approve new guidelines for the regulation of banks and other financial institutions,” Venner said.

He noted that major countries such as the United States of America and the United Kingdom established special committees to review the impact of the crisis and the need for new legislation to at least mitigate future incidents of this magnitude.

In the United States, the Dodd-Frank Act was passed through Congress and, in the United Kingdom, the Vickers Commission provided a comprehensive report proposing a fundamental change in the way that banks operate in that country. Given the scale of the crisis the governments of both countries did what was almost unthinkable prior to the crisis in that they put tremendous amounts of capital into banks which were on the verge of collapse to keep them from failing, which could have led to an even greater financial crisis in those countries, Venner noted.

“These events have affected us deeply as we now live in a globalized and highly interdependent world. Because of these circumstances we must subject ourselves to a severe reality check so that we can reasonably and realistically deal with the challenges which we now face and which will certainly be intensified in the future,” he said.

According to Venner in the financial sector of the sub-region because each country is a separate sovereign entity, even though they use a common currency, there is significant fragmentation of the financial sector, resulting in a large number of financial institutions for a very small population.

He added that the Currency Union has 40 banks, 161 insurance entities, and 57 credit unions for a total population of approximately 600,000. Economic activity in these countries revolve around a limited number of sectors, mainly tourism our main foreign exchange earner, and agriculture, both of which are seasonal activities.

“Much of our recent growth has come from offshore education and Citizenship by Investment Programs. The conclusion from this analysis, in relation to banking, is that commercial banks have a very narrow range of activities to which they can lend which increases the risks they have to face in the market,” Venner said.